Revista Produção e Desenvolvimento, v.5, 2019

DOI: https://doi.org/10.32358/rpd.2019.v5.358

ANALYSIS OF THE SOYBEAN VALUE CHAIN IN THE STATE OF TOCANTINS, BRAZIL

|

Erisvaldo Oliveira Alves1*, Nilton Marques de Oliveira1

1 Universidade Federal de Tocantins, Palmas, 77001923, Brasil.

* alvesbm12@gmail.com |

|

Submitted at 28/09/2018 and accepted at 17/11/2018 |

ABSTRACT

This paper aims to analyze the soybean value chain characteristics in the state of Tocantins, Brazil. The Economic Base Theory was the theoretical input, and the Global Value Chain was the methodology used. The main findings suggest that soybean is the main culture in the agribusiness of Tocantins and its production is for the global marketplace; there is no value aggregation. It was observed that a large share of public funding goes for the business agriculture, and these characteristics aren’t in accordance to the family-based agriculture standard. It is appropriate to add value to the product and to use the North-South Railway in a rational way, thus, providing competitiveness to the chain.

|

KEYWORDS: Global Value Chain; Manufacturing Process; Soybean. |

ANÁLISE DA CADEIA DE VALOR DA SOJA NO ESTADO DO TOCANTINS

RESUMO

Este artigo tem por objetivo analisar as características da cadeia de valor da soja no estado do Tocantins. O aporte teórico foi a Teoria da Base Econômica e a metodologia utilizada foi a Cadeia Global de Valor. Os principais resultados sugerem que a soja é a principal cultura no agronegócio tocantinense, sua produção é destinada ao mercado global; não há agregação de valor. Analisando o financiamento público, observou-se que grande parte se destina à agricultura empresarial, características não condizentes com o padrão de agricultura familiar. É oportuno agregar valor ao produto e utilizar de forma racional a Ferrovia Norte-Sul, proporcionando, assim, competitividade à cadeia.

|

PALAVRAS-CHAVE: Cadeia Global de Valor; Processos industriais; Soja. |

1 INTRODUCTON

The growth rates in soybean yield, along with the international prices, led Brazil to occupy a leading position in the world, becoming the second largest soybean producer, highlighting Mato Grosso as the largest Brazilian state producer, with 31.887 million tons in a cultivated area of 9519 million hectare (ha, Brazilian acronym, ten thousand square meter) with a productivity of 3350 kg ha-1 in the 2017/2018 harvest (Embrapa, 2018).

The Tocantins State has emerged on the national scene as a soybean producer. In accordance with a survey by Companhia Nacional de Abastecimento (National Supply Company) (Conab, Brazilian acronym), the soybean was established in the State of Tocantins as the main agricultural chain, covering 68.07% of 849.63 ha cultivated area in 2015, an increase by 13.5% compared to 2014.

The challenge desired for the state is to double the soybean production area in the next four years, with an increase in 25% a year, reaching 7.2 million tons and two million ha. The soybean producer groups in Tocantins State is composed of small and medium-sized farmers and represented by families coming mainly from the southern region of the country and business groups, farming from 500 to 1000 ha. (Tocantins, 2016).

The development in the soybean production and in the cultivated area is due to increase in the grain demand. Tocantins State has climatic conditions and soils that can be identified as a fundamental factor for this development. Moreover, from the 2000s onwards, the Tocantins State began using more appropriate technologies for planting, and soybeans have become the most productive grain, accounting for about 70% of the state cultivated area (Oliveira, 2018).

This paper aims to characterize and analyze the soybean value chain and its influence on the Tocantins State economy, identifying bottlenecks, governance among agents, checking the links in the Global Value Chain (inputs, production, marketing, consumption), as well as the benefits that the chain tends to bring to the region. Thus, it is understood that this study is timely and needed for knowledge of productive structure and the economic dynamics for the regional development consolidation in Tocantins State. For that purpose, this study is organized as follows: (a) introduction; (b) description of the Global Value Chain, its characteristics and reviewing some papers that approach this methodology along with the presentation of the Economic Base Theory, which will be used to analyze the results; (c) description of the materials and methods used; (d) discussion of the main results; and (e) final considerations.

2 THE SOYBEAN CHAIN VALUE IN THE TOCANTINS STATE

This section presents the Global Value Chain and Douglass North's Economic Theory Base.

2.1 Global value chain

Grimes and Sun (2016), in their work on integrating the Global Value Chain of high technology components in China, state that the Value Chain analyzes how companies organize and locate their different functions to benefit themselves from comparative advantages in different regions where they operate. Other authors explain that, when the value chain involves an aggregate of organizational arrangements and interconnected business, through a global network, the Global Value Chain is established (Giroud &Mirza, 2015; Hernandez & Pedersen, 2017; Marchi, Maria & Ponte, 2014; Mudambi & Puck, 2016).

The Global Value Chain studies all the activities and steps needed to design a product or service from the production until the final consumer, along with special emphasis on chain governance, that is, in what way the production organization, logistics, and marketing are directly or indirectly affected (Gereffi, 2001). Since the agribusiness conceptions developed by Davis and Goldberg (1957), who claim that the term would be the sum of all the operations involving manufacturing, production, storage, processing, and commodities distribution, to the current approach institutional, which involves trading costs and analysis of governance mechanisms, a theoretical theme development is obtained, showing the empirical and applied issues that still have to be solved by the researchers (Zylbersztajn, 2017).

In the same sense, Banga (2013) states that value chains include activities and processes that are needed to take a product from its design and production intermediate stage to delivery to final consumers and destination after used, adding that a global value chain can be understood as the sequence of all the functional activities required in the value creation process involving more than one country.

According to Gereffi and Fernandez-Stark (2016), there are six basic dimensions explored by the Global Value Chain (GVC) methodology. The first set of dimensions refers to global or international elements, and the second set relates to the local elements. The dimensions of the overall set are: (a) input-output structure, which describes the raw material transformation process into final products; (b) geographic scope, which explains how the industry is distributed and in which countries the different GVC activities are carried out; and; (c) governance structure, which explains how the value chain is controlled.

The local dimensions are: (a) upgrading, which describes how producers change among the different chain stages; (b) institutional context, in which the value chain is inserted, and; (c) the stakeholders, which describes how the different local players of the value chain interact (Gereffi & Fernandez-Stark, 2016). In this process, the final product possibilities are verified (Figure 1).

|

|

||||

Figure 1. Final products possibilities in the soybean chain

Source: Pereira (2015)

According to Costa, Guilhoto and Imori (2013), there is lack of incentive for industrialization and value aggregation policies to the agricultural product. In the 2000s, Brazil exported, in monetary terms, about five times more soybeans grains than soybean oil; in addition, in the last 20 years, the annual growth rate of the soybeans grains exports value was 13% compared to 7% of soybean oil.

2.2 Economic base theory

The economic or export base term, according to Lima and Simões (2010), points collectively the exportable products from a region. The development of these exportable products represents a comparative advantage in regional production costs. When regions develop around this base, external economies are generated, which tend to boost the competitiveness and diversification of exportable products. The export base success determines the region growth rate, and the main factors affecting this process are changes in external demand, production cost factors, availability of inputs and raw materials, transportation, technological innovation, and government policy (North, 1977).

According to Lins, Lima and Gatto (2012), the theory of the economic or export base focus the studies in the so-called "new regions", that is, areas whose basic objective was to explore the land and its resources for producing goods that could be marketed "outside" (in foreign countries) and that would become monetary income, based on few exportable products. In these cases, the secondary and tertiary sector (the one that is not the base) was indifferent, since it was only intended to meet the local consumption needs.

Despite critics of this theory, it

is plausible to accept the thinking of Lins, Lima, and Gatto (2012), stating

that criticisms directed to the great importance given to the exported

component as growth generator and economic development correspond to say that

the export base is not necessarily the main autonomous variant that defines the

growth, but it is related to the economic dynamics of the region. In the short

run, other autonomous variant, other than exports, can be dynamic when

determining income, such as, for example, commercial investments, government

expenditures, and residential constructions. However, the main function of the

economic base would not be to determine short-term income, but to explain

economic development in the long run.

3 MATERIALS AND METHODS

This research is of the applied type and uses the global value chain methodology to structure the discussion. This methodology is an effective way to analyze individualized production, contextualizing activities that involve the product, as well as, analyzing the governance question, organization, and management (Gereffi, 2001).

As for the goals, it is an exploratory research that uses qualitative data, passed on by players who comprise the chain as representatives of government agencies and employees of companies in the agro-export sector, as well as quantitative data from secondary sources, such as technical reports, articles, and statistical data from government agencies and associations.

4 RESULTS AND DISCUSSION

This section presents the results by the methodology proposed, and the presentation was made in accordance with the dimensions of the Global Value Chain methodology.

4.1 Input-Product

According to Tocantins (2016), the regional cost of soybean production in Tocantins State is estimated in R$ 2,200.00 per ha (R$ is Brazilian Real currency symbol) with fertilizer expenditure accounting for the highest rate at 27%, while the seed is the lowest input cost, equivalent to14% of the production cost (Table 1).

As Journal of Tocantins (2013) reported, in addition to production costs, the land cost has been increased in the state in the last 10 years by 680%, which would be related to the existence of the economic area called MATOPIBA; the land cost accounted for 18% of total production cost in the 2016/2017 summer harvest. Recently, there was another regionalization of this area, which may help to explain the aptitude character for the agribusiness of Tocantins State and the increase in land cost in the region. Also, as Tocantins (2016) reported, having as reference the Pedro Afonso center, it is known that the technological level of the producers’ machines and equipment are equal to the great producing centers of the country, which are acquired in fairs as AGROTINS, which takes place in Palmas, capital city of Tocantins State, which is considered the largest agricultural fair in the northern Region. Regarding the seeds, it is estimated that 70% of seeds are coming from Várzea de Formoso region in Tocantins State, and the remaining seeds are from Formosa municipality, Goiás State. As stated by a civil servant (via telephone, on 7 Dec. 2017) of the Department of Agriculture and Livestock of Tocantins (Seagro, Brazilian acronym), two companies (Unigell and Talismã) sell seeds in the state and are responsible for most of the seeds used in soybean production.

Table 1. Production cost per hectare in Tocantins State, 2015

|

Description |

Cost (R$) |

(%) |

|

Seeds |

300.00 |

14 |

|

Pesticides |

450.00 |

20 |

|

Fertilizers |

600.00 |

27 |

|

Manpower |

440.00 |

20 |

|

Equipment/Logistics |

410.00 |

19 |

|

Total |

2,200.00 |

100 |

Source: Tocantins (2016)

According to the Ministry of Agriculture, Livestock and Food Supply (MAPA, Brazilian acronym) (2018), Tocantins State exported soybeans equivalent to 1,218,257,694 kg in 2016, at the value of R$ 447,801,309, representing 71% of all the agribusiness in this state, showing the weight of soybean to the Tocantins State economy. Tocantins (2016) states that fifteen companies commercialize soybeans in Tocantins State (ADM Co., BUNGE Co., CARGIL Co., CHS Co., CGG Co., GRANOL Co., NIDEIRA Co., FAZENDÃO Co., AMAGGI Co., MULTIGRAIN Co., SODRU Co., ALGAR Co., GLENCORE Co., GAVILON Co., and TOYOTA Co.). This fact shows the state ability to export, thus supporting growth and development policies, grounded in this type of trade, generating a multiplier effect on local or nonbasic activities, according to the economic base theory.

Within the input-output dimension, grain transportation in Tocantins State is done through highways and the North-South Railroad. Soybeans to be exported leave the region silos and warehouses to the courtyard located in the municipality of Palmeirante, in the northern region of the Tocantins State (TO); although goods transport by railway is cheaper than the road transport, a good part of the soybean from Tocantins State moves by truck to Palmeirante, to only then shifting to the railway transport. From the soybean courtyard, it goes by train from the North-South Railroad to Açailândia, Maranhão State (MA), Brazil, from where it heads towards the Itaqui harbor in Maranhão, going to the foreign market (Tocantins, 2016). At this point, there is a bottleneck, because the export base theory considers possible to produce few exportable goods, initially; however, it would be necessary to lower transportation costs to diversify the base, whose development is necessary to achieve the region development.

Regarding the Processing, data from 2016 registered Tocantins State with 2% in the country oil production capacity, and it can process 3020 tons of soybean per day; regarding the refining and container capacity, there are no records of accomplishment of these steps. There are processing units in the city of Cariri do Tocantins, belonging to Fazendão Agronegócio Co., which processes the grain with solvent and produces deactivated soybean, flour, and degummed oil (Abiove, 2017).

In this state, there are two biodiesel industries, GRANO Co. in Porto Nacional municipality, and BIOTINS Co. in Paraíso do Tocantins municipality (Zuniga, 2015). By verbal information from an employee of the Integrated Logistics Value (contact phone, on 8 Nov. 2017) and also from the representative employee of SEAGRO Co.( contact phone, on 7 Dec. 2017), both said that biodiesel production is not occurring in industrial plants, even though there is an entire apparatus of equipment for this matter.

In accordance with Moreira (2016), Tocantins State production has the stamp from Social Fuel, licensed by the Ministry of Agrarian Development (MDA, Brazilian Acronym), and, for obtaining this stamp, the company must acquire at least 15% in raw material from family-based farmers; the author states that the GRANO Co. located in Porto Nacional was the only one that produced biodiesel in 2014 and 2015, representing 2.15% and 1.8% of the national production, respectively. The main issue of emergent commodity industrialization (soybean) is based on the concept presented by North (1977), according to which, the increase in the local population requires the product manufacture implementation as a means to maintain a sustainable development.

4.2 Geographical scope

This study has the Tocantins State as geographical limit, aiming to describe the soybean value chain in this area. By the information from the Planning Secretariat of Tocantins State (SEPLAN, Brazilian acronym), most soybeans grown there do not stay in the region, it is exported:

“portion of 85% of soybeans is reserved for the external market, mainly for Asia and Europe, and 15% for the domestic market. The portion sold to the domestic market can get a better value, but it is necessary to wait for the right time to sell, and sometimes the producer must sell the product to honor commitments.” (Tocantins, 2016. p.123)

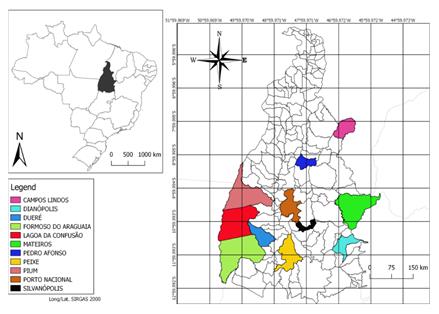

Tocantins (2016) shows production centers, which are distributed by the state areas with different characteristics, but due to the right treatment it can be possible to develop the specific cluster (Figure 2).

Figure 2. Soybeans Production Centers in Tocantins State

Source: Authors, on the basis of Tocantins (2016)

Tocantins State has emerged on the national scenario in relation to grain production, and soybeans are the main crop with 2.22 million tons produced in 2013/2014 (Borghi, 2014 & Oliveira, 2015). In accordance with Agro-livestock cooperative of Pedro Afonso (COAPA, Brazilian acronym), the pesticides are purchased from São Luiz mixers, Maranhão State, and transported by truck wagon to Pedro Afonso, at an average cost of R$ 450.00 per ha-1. The fertilizers are acquired from the big multinationals of the segment, with a cost of R$ 600,00 per ha-1. These costs were rolled by the COAPA Co. monitoring team (Tocantins, 2016).

Regarding sales, the main markets for soybeans from Tocantins State are China and the European Union. As the Ministry of Agriculture, Livestock, and Supply, exports to China accounted for 50.29% in 2016 equivalent to US $ 225,206,480.00. In the same year, 46% of exports was sent to the EU block for US $ 205,987,925.00. In 2017, there was an increase in the soybean complex exports to China, which received 72.16%, while for the European Union there was a decrease in 16.26% of all soybean exports (Mapa, 2018).

4.3 Governance

Significant part of the governance in the soybean value chain belongs to the production funding-holders. Rodrigues et al. (2010), analyzing the producers ‘funding sources of the Santa Rosa do Tocantins region, claim that due to the rural credit scarcity and bureaucracy, the trading has become the main resource sources. A concept of trading would be that multinational companies fund the producer, thus receiving payment in soybean for export, practicing lower prices; these companies sign for contracts with fixed prices and quantities based on future price.

In Rodrigues et al. (2010) research, it was verified that 50% of the contracts carried out in the fixed price modality caused financial loss to the producers. The main trading that operate in the state have different specifications (Chart 1).

Chart 1. Main soybean trading in Tocantins State

|

COMPANIES |

ATIVITIES |

|

BUNGE ALIMENTOS Co. |

The company purchases more than 20 million tons of grain per year and regularly interacts with customers from all continents. It is the largest exporter in Brazilian agribusiness |

|

CARGIL Co. |

It is

considered one of the main companies in the |

|

MULTIGRAIN Co. |

It is among the largest soybean exporters in Brazil and maintains strategic partnerships in the domestic market, as well as trading the product in the main markets in Europe and Asia |

|

ABC ALGAR Co. |

It is a company that has been operating in the soybean market since 1978. In addition to the production, processing and commercialization of soybeans in the domestic and foreign markets, it has anchor products, its own production, soybean oil ABC, soybean meal RaçaForte |

|

CGG TRADING Co. |

The CGG Group was created in 2010, operates in the production, commercialization and logistics of agricultural commodities in an integrated way. It has direct access to major international markets with an emphasis on Asia |

Source: Tocantins (2016)

The provided verbal information by SEAGRO Co.'s civil servant (phone contact, on 7 Dec. 2017) is that the value of interest on the funding may reach 20% of the amount funded, representing a value well above public funding, and that the public funding is carried out mainly by Banco do Brasil and Banco da Amazônia. It was also informed that SEAGRO Co. evaluates the product quality standard, and that this company has a grain sorter in the Pedro Afonso municipality, and that FOCOAGRO Co. also operates as a trading company in state.

Rodrigues et al. (2010) state that,

in the soybean production system, the relationship is well-defined, along with

private credit arrangements being represented by the so-called trading, which fund 67% of

the national soybean production, reaching 80% in some places. Regarding public

funding, from the point of view of the resource distribution at the

national level, the average contractual values were higher in the region called

MATOPIBA, in addition to Roraima and Amapá States. In all these states, the

funding contractual average value was higher than the national average contractual

value in soybean crop (Freitas & Santos, 2016).

Considering the comparative state data, the hypothesis raised here is that in Tocantins State the soybean crop is not characterized by small producers, nor does it show family-based farming characteristics. The states of Rio Grande do Sul, Santa Catarina, and Paraná, Brazil southern region, have a contract value close to half the national average, with an average at R$ 45,705.00; R$ 44,731.00; and R$ 67,065.00, respectively, compatible with a family-based agriculture funding standard, and this average contractual value occurs even though there are large amounts of funds destined to financing, more than R$ 12 billion in Paraná and almost R$ 11 billion in Rio Grande do Sul, from January 2013 to December 2015.

On the other hand, the MATOPIBA region (part of Maranhão, Piauí, Bahia, and the entire Tocantins State), along with regions of Mato Grosso and Pará States, a group that have been inserted in the project of economic region denominated North Central Brazil, have funding values that are relatively higher than the national average, such as Piauí State with average value 9.2 times higher than the national average, and the state of Pará showing the lowest relative value of the group, with contracts relatively three times higher than the national average.

At this resource distribution pattern, these states have high average funding, as R$ 561,710.00 for Mato Grosso, R$ 651,556.00 for Bahia, R$ 1,013,549.00 for Piauí, R$ 790,754.00 for Maranhão, R$ 329,149.00 for Pará, and R$ 471,096.00 for Tocantins State. Therefore, these values do not have a pattern compatible with family-based farming; for example, a producer in the Tocantins State finances on average close to half a million reais (Brazilian currency) per contract; considering the Tocantins State social structure, this value considerably limits the population who are able to contract the funding. Each unit of the federation (UF) has its average contract value compared to the national average value and how much each state had in volume to be funded in the analized period (Table 2).

Table 2. Value contracted by state

|

Average Value Contracted per UF for Costing Soybean Crops (January 2013 - December 2015) |

|||

|

R$/Contract (UF versus Brazil) |

Soybean - Average (R$/Contract) |

Soybean Total (R$) |

UF |

|

0.6 |

67,065.00 |

12,387,524,059.00 |

PR |

|

0.4 |

45,705.00 |

10,711,393,170.00 |

RS |

|

0.4 |

44,731.00 |

1,273,572,877.00 |

SC |

|

5.1 |

561,710.00 |

10,120,331,466.00 |

MT |

|

5.9 |

651,556.00 |

3,468,882,123.00 |

BA |

|

9.2 |

1,013,549.00 |

1,595,325,404.00 |

PI |

|

7.2 |

790,754.00 |

1,290,509,955.00 |

MA |

|

3.0 |

329,149.00 |

235,670,993.55 |

PA |

|

4.3 |

471,096.00 |

1,723,739,990.66 |

TO |

|

0.7 |

76,626.00 |

153,253.00 |

CE |

|

5.1 |

567,030.00 |

22,114,181.55 |

AP |

Source: Authors, adapted from Freitas and Santos (2016)

Note: UF= Unit of Federation; PR=Paraná State; RS=Rio Grande do Sul State; SC=Santa Catarina State; MT=Mato Grosso State; BA=Bahia State; PI=Piauí State; MA=Maranhão State; PA=Pará State; TO=Toantins State; CE=Ceará State; AP=Amapá State.

The states of Ceará and Amapá (Table 2) show characteristics related to the two groups above discussed; the state of Ceará has an average individual funding amount of R$ 76,626.00, below the national average, closer to the southern country standard, but the total amount of resources funded in the period is small compared to the group showed, only R$ 153,253.00. The state of Amapá has an average individual contract value of R$ 567,030.00, which is closer to the standard showed in the North Central Brazil group, value that limits the access to resources to a small producer group; the total value of the available resources for the soybean crop in this state was also small in comparison to the analyzed groups (R$ 22,114,181.55).

Finally, by comparing Tocantins and Santa Catarina, states with similarities in the total resources available in the period, R$ 1,723,739,990.66 and R$ 1,273,572,877.00, respectively, and individual average contract values of R$ 471,096.00 and R$ 44,731.00, respectively, it can be concluded that in Tocantins State the soybean production model is not represented by family-based farmers, because the average contract value in this region would fund, on average, more than ten contracts in the Santa Catarina State.

Governance in the soybean value chain of Tocantins State appears as the market governance type, "The essential point is that the costs of switching to new partners are low for both parties" (Gereffi, Humphrey & Sturgeon, 2005, p.83). In this governance type, there is no dependence relationship among buyers and sellers, since price is the determining trading factor and is characterized by low specificity of assets and low uncertainty of trading, "Choosing a planting because of a particular raw material is related to the financial issue. The choice for the soybean commodity is given by the market offer and there are no incentives for planting other raw materials" (Moreira, 2016, p.72).

4.4 Socio-institutional context

According to the Brazilian Complementary Law No. 87 of 1996 (Kandir Law), exported soybeans in grains, oil, and flour were exempt from Tax on the Circulation of Goods and Provision of Services (ICMS, Brazilian acronym). However, the incidence of this tax on internal trading represents a tax distortion insofar as it favors the export of soybeans to the detriment of processing, compromising the industrial scope, and favoring the increase in idleness (Freitas, Barbosa & Franca, 2000).

According to the SEAGRO Co. civil servant (contact on 7 Dec. 2017), the State Treasury Department (Secretaria da Fazenda do Estado, SEFAZ TO, Brazilian acronym), has a decree that endorses the Kandir Law, and recently the state decided to tax the soybean exports, but, because the producers’ reaction, the exemption decree was renewed. North (1977) explains that this tendency must be worked out by public policies. According to this author, there is a conservative tendency reinforced by the dynamics of capital, which is attracted to the new regions in the development phase of primary products export activities; as long as there is insufficient income to supply much of the investment capital, this region tends to rely on external sources, which will be applied to existing export activities rather than new or untested companies, conserving the current export base, even at the expense of sustainable development and full development of the region.

4.5 Stakeholders

The employee of the VLI Co.(phone contact on 8 Nov. 2017) explained that the price is set in accordance with the Chicago Stock Exchange, by which, the costs are deducted until reaching the producer; therefore, the price control is defined by the exporters, since they are the ones who buy to resell in the international market. In addition, VLI Co. has a promoting department for soybean development in Tocantins State, as the company works (through concession) transporting the product through the North-South Railway and, as the representative employee (phone contact on 8 Nov. 2017) said, most of the transported soybean is from Mato Grosso State, because Tocantins State is not able to meet the demand, and it is necessary that the company itself tries to promote the chain development to have demand for its services.

The company goal is that the

product to be transported has more and more added value, because the

transportation of the soybean flour is more profitable than the soybean grain,

just as the transport of the meat is more profitable than the soybean flour;

the goal would be to use transport container, but, again, it comes up against

demand, there is no constant product flow to guarantee the investment return.

Regarding the incentive to agribusiness, VLI Co. believes that there is room

for the soybean crop development in an area of five million hectares; the

company representative employee (phone contact on 8 Nov. 2017) explained that these areas would be the degraded

areas, and the production defended by the company is through the low carbon

production, agriculture-livestock, and native forest integration. There

are several Stakeholders as part of this productive chain (Chart 2).

Chart 2. Main stakeholders of Soybean in Tocantins State

|

Stackholders |

Level of importance |

Power and influence |

|

Suppliers of input |

High |

High |

|

Conveyors |

High |

Low |

|

Producer |

High |

Low |

|

Research Centers (EMBRAPA/Universities) |

High |

Low |

|

Manufacturing industry |

Low |

Low |

|

Storage Systems |

Low |

Low |

|

CONAB |

High |

Low |

|

Tradings |

High |

High |

|

Wholesalers/Retailers |

Low |

Low |

|

Regulating agents (Ministry and Departments) |

High |

Low |

|

Unions and producers associations |

Low |

Low |

|

Consumer |

High |

Low |

Source: Authors according to research data

Therefore, the influence power in this chain is located outside the region, that is, any variation in the inputs price and/or in the grain price falls on the cultivated area that will suit and absorb the effects mostly negative.

4.6 Upgrading

A technological action to make the soybean chain more competitive carried out by Embrapa soybean and the Research Support Foundation of the North Exportation Corridor (Fapcen, Brazilian acronym) was the development of two soybean cultivars, BRS 8590 and BRS 8890RR, indicated to the north of Tocantins State, for having short cycle of 110 days (Moreira, 2016). Technological innovations are indispensable for the producer region to be able to compete with other producer regions or countries (North, 1977).

North (1977) stated in detail that, in new regions, such as the Tocantins State, public policies should make efforts to prevent external economies and technological development from neutralizing the decreasing in returns from the basic product, resulting in increased dependence on current export products, to the detriment of promoting changes in the exporting base. In other words, the advantages from technological actions should not reinforce the simple maintenance of the soybean export in grains, to the detriment of the product value aggregation still in Tocantins State soil.

5 FINAL CONSIDERATIONS

In the economic globalization process, international trade has changed considerably, occurring a fragmentation of productive processes and its geographic dispersion into value global chains. The contribution of the global value chain of the soybean from Tocantins State lies in the fact of inserting the state economy in an international trade through an export intake of this product.

Another important point is the high technology implementation for cultivating this oilseed, as well as, advanced equipment to crush the grain. This technological apparatus, along with the presence of institutions that study and show innovative solutions, such as Embrapa, can be understood as positive externalities for Tocantins State.

This chain leads to the development of several others, besides public and private investments in storage structures, grain processing, transport and export of soybean and its derivatives. Even with the whole development in the process of the soybean value chain in the Tocantins State, this crop still represents little in relation to that produced by other states in the country. Even though there is a prominent role in the agribusiness of Tocantins State, most of the soybean produced is exported in grains, which generates little internalization of the economic dynamism and little revenue for the state.

According to the perspective of North's (2016) economic base theory, soybean in Tocantins State is close to that recommended as a basic product, because it provides economic dynamism; however, the theory postulates that having comparative advantages at first, the economic sustenance begins on the basis of commodities, but it must add value to become an export product with competitive advantages; in addition, the economic results of this development must be internalized in the region, as well as, it is necessary to diversify the products of the export base to maintain sustainable development.

To generate economic effects that benefit all the local population, transforming economic growth in development, it is necessary to solve some bottlenecks such as high cost of inputs, little value aggregation (most of soybeans are sold in grains), little power to influence the price, and little internalization of the benefits of the growth of this chain (external capital).

A product industrialization has begun, the value chain of soybean from Tocantins State did not reach the last stage of the economic export base theory, which would be the value aggregation to the product, starting to export manufactured products; in addition, the grain processing (crushing) suffers from idleness. Soybean production in Tocantins State is not associated with family-based agriculture, considering that crop funding data show the contracts high values, indicating a type of funding for large producers. The southern states of Brazil, for example, have a much lower average value per contract, approaching a funding pattern for small producers.

Therefore, it is needed to add value to soybean of Tocantins State because the region shows comparative advantages for it, but it must turn them into competitive advantages and aims to internalize the gains of the soybean production chain; there is still a great need for public resources to maintain this chain with essential public policies for the construction and maintenance of infrastructure for the crop development. Most of the soybean is exported in natura, which favors a considerable waiver of taxes against the state, so, it is needed that the decision power is moved to the local players and, for that, it is needed to industrialize the chain in Tocantins State itself.

Although, soybean production is important for the agribusiness in Tocantins State, it is little representative in relation to the national production. Processing capacity is still limited, production costs has the input as the biggest bottleneck, and the expected benefits from the construction of the North-South Railroad have not yet been received. For all these situations, the soybean value chain still does not show generating, at the state level, the expected development of a commodity as defined in the economic export base theory.

REFERENCES

ABIOVE. Pesquisa de Capacidade Instalada da Indústria de Óleos Vegetais 2017. Disponível em: < http://www.abiove.org.br/site/index.php?page=estatistica&area=NC0yLTE=>. Acesso em: 11/07/2018.

BANGA, Rashmi. Measuring value in global value chains. In: Regional Value Chains Background Paper. RVC-8, United Nations Conference on Trade and Development, Anais…, Geneva. 2013. Disponível em: <http://unctad.org/en/PublicationsLibrary/ecidc2013misc1_bp8.pdf>. Acesso em: 20/02/2018.

BORGHI, E. et al. Produção de soja no Estado do Tocantins: percepções inicias sobre o sistema produtivo. In: REUNIÃO DE PESQUISA DE SOJA, Londrina-PR, 2014. Anais.... Londrina PR, 2014. p. 18-22. Disponível em: <https://www.alice.cnptia.embrapa.br/bitstream/doc/993365/1/ProducaodesojanoEstadodoTocantinspercepcoesiniciassobreosistemaprodutivo..pdf>. Acesso em: 10/07/2018.

BRAZIL. Estudo da dimensão territorial para o planejamento: Volume III – Regiões de referência. Brasília: Ministério do Planejamento, 2008. 150p. Disponível em: < https://www.unc.br/mestrado/mestrado_materiais/21.10.09-Min_do_Planejamento-Volume3.pdf>. Acesso em: 13/04/2017.

BRAZIL. Lei Complementar no 87, de 13 de Setembro de 1996. Dispõe sobre o imposto dos Estados e do DF sobre operações de circulação de mercadorias e prestação de serviços (LEI KANDIR). Diário Oficial da República Federativa do Brasil, Poder Executivo, Brasília – DF, de 16 de setembro de 1996. p. 18261. Disponível em: < http://www.planalto.gov.br/ccivil_03/leis/lcp/lcp87.htm>. Acesso em: 12/07/2018.

COSTA, Cinthia Cabral da; GUILHOTO, Joaquim José Martins; IMORI, Denise. Importância dos setores agroindustriais na geração de renda e emprego para a economia brasileira. Revista de Economia e Sociologia Rural, v. 51, n. 4, p. 787-814, 2013.

DAVIS, John Herbert; GOLDBERG, Ray Allan. Concept of agribusiness. Boston: Division of Research, Graduate School of Business Administration, Harvard University.1957, 136p.

FREITAS, Silene Maria de; BARBOSA, Marisa Zeferino; FRANCA, Terezinha JF. Cadeia de produção de soja no Brasil: o caso do óleo. INFORMACOES ECONOMICAS - IEA, v. 30, n. 12, p. 30-41, 2000. Disponível em: <http://www.iea.sp.gov.br/out/LerRea.php?codTexto=13040>. Acesso em: 18/04/2018.

EMBRAPA. Sojá em números (Safra 2017/2018). Disponível em:<https://www.embrapa.br/soja/cultivos/soja1/dados-economicos>. Acesso em: 10/07/2018.

FREITAS, Rogério Edivaldo; SANTOS, Gesmar Rosa dos. Desafios do financiamento agropecuário: o complexo produtivo soja-milho-aves. Radar _47 – IPEA, 2016.

GARCIA, Junior Ruiz; FILHO, José Eustáquio Ribeiro Vieira. O papel da dimensão ambiental na ocupação do MATOPIBA. Confins. Revue franco-brésilienne de géographie/Revista franco-brasileira de geografia, n. 35, 2018. Disponível em: <https://journals.openedition.org/confins/13045#bodyftn1>. Acesso em: 11/09/2018.

GEREFFI, Gary et al. Introduction: Globalisation, value chains and development. IDS bulletin, v. 32, n. 3, p. 1-8, 2001. Disponível em: <http://oro.open.ac.uk/8560/1/fulltext.pdf>. Acesso em: 04/05/2018.

GEREFFI, Gary; HUMPHREY, John; STURGEON, Timothy. The governance of global value chains. Review of international political economy, v. 12, n. 1, p. 78-104, 2005.

GEREFFI, Gary; FERNANDEZ-STARK, Karina. Global Value Chain Analysis: A Primer. 2 ed. 2016, p. 34.

GIROUD, Axèle; MIRZA, Hafiz. Refining of FDI motivations by integrating global value chains’ considerations. The Multinational Business Review, v. 23, n. 1, p. 67-76, 2015.

GRIMES, Seamus; SUN, Yutao. China’s evolying role in Apple’s global value chain. Area Development and Policy, v. 1, n. 1, p. 94-112, 2016.

HERNANDEZ, Virginia; PEDERSEN, Torben. Global value chain configuration: A review and research agenda. BRQ Business Research Quarterly, v. 20, n. 2, p. 137-150, 2017.

JORNAL DO TOCANTINS. Preço da Terra no Tocantins aumenta 680% em dez anos. INFORMA ECONOMICS FNP, 28 mar. 2013. Disponível em: <http://informaecon-fnp.com/noticia/8936>. Acesso em: 25/04/2017.

LIMA, Ana Carolina da Cruz; SIMÕES, Rodrigo Ferreira. Teorias clássicas do desenvolvimento regional e suas implicações de política econômica: o caso do Brasil. RDE-Revista de Desenvolvimento Econômico, v. 12, n. 21, 2010. Disponível em: <http://www.revistas.unifacs.br/index.php/rde/article/viewFile/878/940>. Acesso em: 02/05/2018.

LINS, Andréia do Egito; LIMA, João Policarpo Rodrigues; GATTO, Maria Fernanda. Uma aplicação da teoria da base exportadora ao caso nordestino. Revista Econômica do Nordeste, v. 43, n. 1, p. 9-32, 2012. Disponível em: <https://ren.emnuvens.com.br/ren/article/viewFile/205/183>. Acesso em: 18/05/2018.

MAPA. Estatísticas de comércio exterior do agronegócio brasileiro. Brasília, DF: AgroStat Brasil, 2018. Disponível em: <http://indicadores.agricultura.gov.br/agrostat/index.htm>. Acesso em: 05/06/2018.

MARCHI, Valentina de; MARIA, Eleonora Di; PONTE, Stefano. Multinational firms and the management of global networks: Insights from global value chain studies. In: Orchestration of the global network organization. Emerald Group Publishing Limited, 2014. P. 463-486.

MOREIRA, Wislayne Aires. Prospecção de cenários: um estudo da cadeia de produção de biodiesel do Tocantins. 2016. 103 f. Dissertação (Mestrado em Engenharia de Produção e Sistemas) – Universidade do Vale do Rio dos Sinos – RS, 2016. Disponível em: <http://www.repositorio.jesuita.org.br/handle/UNISINOS/5391?show=full>. Acesso em: 10/07/2018.

MUDAMBI, Ram; PUCK, Jonas. A global value chain analysis of the ‘regional strategy’ perspective. Journal of Management Studies, v. 53, n. 6, p. 1076-1093, 2016.

NORTH, Douglass C. Teoria da localização e crescimento econômico regional. In: Schwartzman, J. (Org). Economia regional: textos escolhidos. Belo Horizonte: Cedeplar, Cetrede, Minter, p. 333-343, 1977. Disponível em: <http://www.ifibe.edu.br/arq/20150824222519320995672.pdf>. Acesso em: 10/07/2018.

OLIVEIRA, Nilton Marques de. Desenvolvimento Regional do Território do Estado do Tocantins: Implicações e Alternativas. 2015. 260 f. Tese (Doutorado em Desenvolvimento Regional e Agronegócio) – Centro de Ciências Sociais Aplicadas, Universidade Estadual do Oeste do Paraná, Toledo – PR, 2015. Disponível em: < http://tede.unioeste.br/handle/tede/2180>. Acesso em: 20/04/2017.

OLIVEIRA, Nilton Marques de. Produção Agropecuária Agregada: uma aplicação para o estado do Tocantins. Revista Desafios, v. 5, n. 1, p. 135-147, 2018.

PEREIRA, Marco Antônio. CADEIA PRODUTIVA DO FARELO DE SOJA: Um enfoque na produção nacional. 2015. 19 f. TCC (Graduação) - Curso de Engenharia de Produção, Universidade de Rio Verde, Rio Verde, 2015.

RODRIGUES, Waldecy et al. Análise das estratégias de financiamento e comercialização dos produtores de soja da região de Santa Rosa do Tocantins/TO. Informe Gepec, v. 14, n. 2, 2010. Disponível em: <http://e-revista.unioeste.br/index.php/gepec/article/view/2129>. Acesso em: 04/01/2018.

TOCANTINS. Secretaria do Planejamento e Orçamento. DIAGNÓSTICO DO AGRONEGÓCIO (P4). 2016. Disponível em: <http://web.seplan.to.gov.br/workshop/documentation/Diagnostico_Agronegocio.pdf>. Acesso em: 03/12/2017.

ZUNIGA, Abraham Damian Giraldo et al. Situação atual e perspectivas do biodiesel no Estado do Tocantins. Revista Desafios, v. 1, n. 1, p. 263-278, 2015.

ZYLBERSZTAJN, Decio. Agribusiness systems analysis: origin, evolution and research perspectives. São Paulo. Revista de Administração, v. 52, n. 1, p. 114-117, 2017. Disponível em:< http://www.scielo.br/scielo.php?pid=S0080-21072017000100114&script=sci_arttext>. Acesso em: 15/03/2018.

![]() Esta obra está

licenciada sob uma licença Creative Commons Atribuição

4.0 Internacional.

Esta obra está

licenciada sob uma licença Creative Commons Atribuição

4.0 Internacional.

APA citation format: Alves, E., & Oliveira, N. (2019). ANALISE DA CADEIA DE VALOR DA SOJA NO ESTADO DO TOCANTINS. Revista Produção e Desenvolvimento, 5. doi:https://doi.org/10.32358/rpd.2019.v5.358

ABNT citation form: ALVES, Erisvaldo Oliveira; OLIVEIRA, Nilton Marques de. ANALISE DA CADEIA DE VALOR DA SOJA NO ESTADO DO TOCANTINS. Revista Produção e Desenvolvimento, [S.l.], v. 5, jan. 2019. doi:https://doi.org/10.32358/rpd.2019.v5.358.